SatoSheets

Your Simple Crypto Tax Companion

Import wallets, track transactions, and export reports—all in one place

SatoSheets simplifies cryptocurrency accounting and tax reporting for individuals and businesses. Calculations are estimates; review with a tax professional.

Core Features

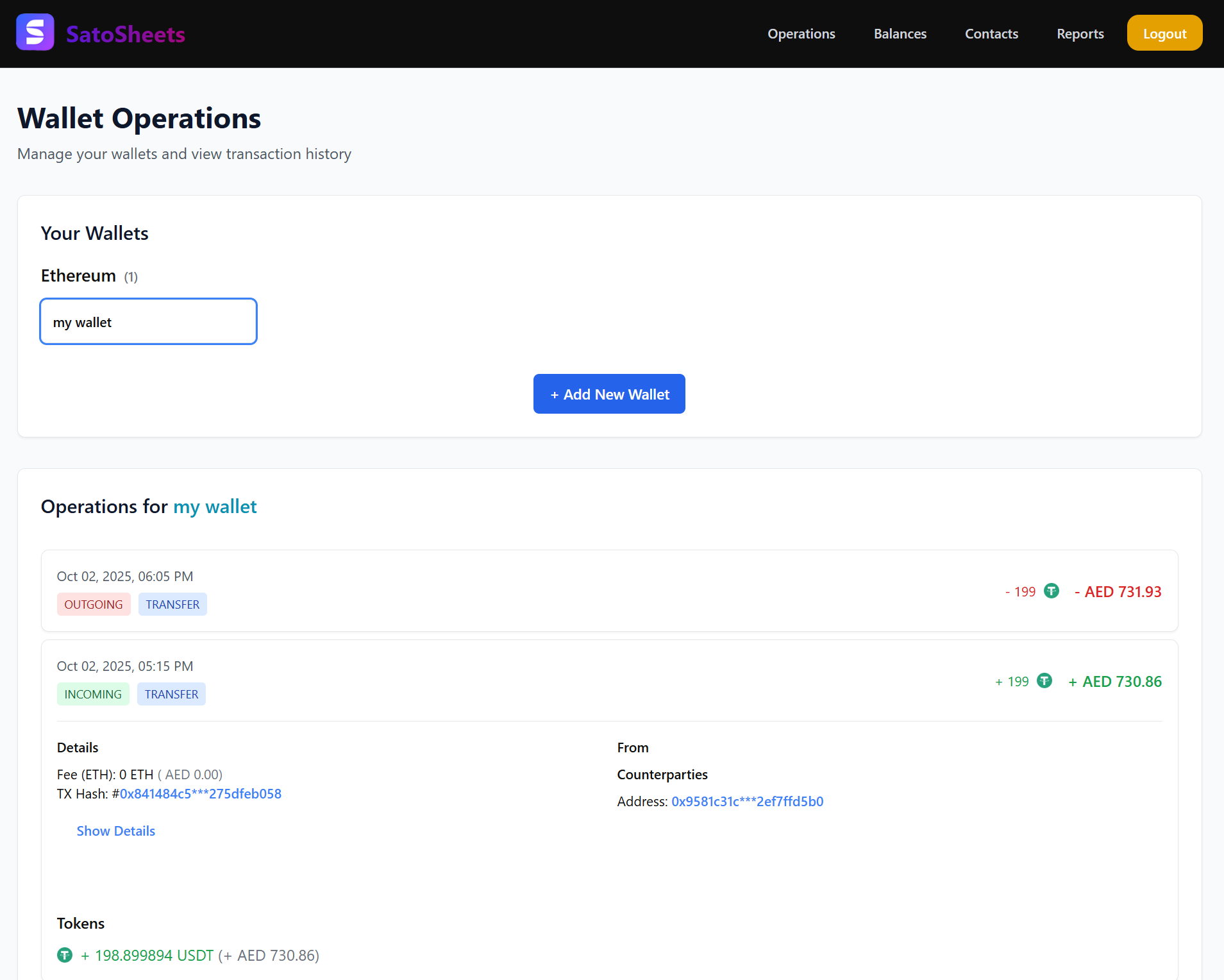

💼 Wallet Operations

Manage multiple wallets across different blockchains. Import wallet addresses, view transaction history, and track incoming and outgoing transfers with detailed fee information.

- Multi-wallet support (Ethereum, Bitcoin, and more)

- Transaction history with timestamps

- Detailed fee tracking (ETH, AED, USD)

- TX Hash and counterparty address display

📊 Balances & Portfolio

Real-time portfolio tracking with multi-currency valuation. Monitor your token holdings and their current market values across all connected wallets.

- Real-time token balances

- Multi-currency conversion (USDT, AED, etc.)

- Portfolio value tracking

- Historical balance snapshots

📈 Reports & Tax Export

Generate comprehensive tax reports with transaction categorization. Export data in formats compatible with tax software and accounting systems.

- Tax report generation

- Transaction categorization

- Cost basis calculation (FIFO, LIFO)

- Export to accounting software

Platform Capabilities

- Automated Transaction Import: Connect wallets and automatically import transaction history from major blockchains

- Multi-Chain Support: Track transactions across Ethereum, Bitcoin, and other popular networks

- Transaction Details: View TX hashes, fees, counterparty addresses, and token amounts for every operation

- Transfer Categorization: Automatic classification of incoming and outgoing transfers

- Multi-Currency Valuation: See balances in USDT, AED, USD, and other fiat currencies

- Contact Management: Save and manage counterparty addresses for easier tracking

- Secure Platform: Data encryption and privacy protection for all your crypto transactions

Why Choose SatoSheets?

- Save hours on manual crypto bookkeeping and transaction tracking

- Ensure compliance with tax regulations through accurate reporting

- Gain clear visibility into all your crypto holdings and operations

- Reduce errors in financial reporting with automated calculations

- Streamline audit preparation with comprehensive transaction history

- Access your data anytime with cloud-based secure storage

⚠️ Important Disclaimer: SatoSheets is not a tax advisor. All calculations are estimates and should be reviewed with a qualified tax professional. See our Disclaimer for more information.